Long-Term Scarcity and Monetary Properties Explained

Discover how long-term scarcity shapes monetary properties, store of value, and sound money in a world of inflation, technology, and digital assets.

Understanding the connection between long-term scarcity and monetary properties is essential in a world where money, value, and technology are changing faster than ever. People are increasingly asking why some assets hold value across decades while others slowly lose purchasing power. At the heart of that question lies a simple but powerful idea: anything that serves as money must balance usefulness today with credible scarcity over time.

From gold and fiat currencies to cryptocurrencies and digital assets, the story of money can be seen as a constant search for the right combination of scarcity, trust, and usability. When an asset exhibits strong monetary properties such as being a store of value, a medium of exchange, and a unit of account, it can support trade and savings across generations. When it fails, people look for alternatives that better protect their future.

In this article, we will explore how long-term scarcity influences the success or failure of different forms of money, why scarcity alone is not enough, and how technology is reshaping what we think of as sound money. We will unpack key economic concepts in accessible language and connect them to real-world examples, from precious metals to modern digital currencies.

Table of Contents

ToggleWhat Is Long-Term Scarcity?

Long-term scarcity means more than simply being hard to find. It refers to an asset whose supply is limited not only today but also in a reliable way far into the future. When people talk about long-term scarcity and monetary properties, they are really asking whether an asset can remain rare and valuable over decades, and whether its supply can be predicted and trusted.

Gold is a traditional example. It is naturally scarce, difficult to mine, and cannot be created at will. Even with modern technology, the annual increase in gold supply is relatively small. This slow and predictable growth in supply is one reason gold has historically been seen as sound money and a store of value.

Fiat money, such as dollars or euros, offers a contrasting example. It is not scarce by nature; it is created by governments and central banks. Its supply can expand significantly in response to political and economic decisions. While this flexibility can be useful for managing crises, it also means fiat money often lacks long-term scarcity, which can weaken its ability to preserve purchasing power over many years.

In recent years, digital scarcity has emerged as a new concept. Cryptocurrencies such as Bitcoin introduced the idea of a mathematically enforced supply cap. In theory, this creates a kind of algorithmic, programmed scarcity that does not depend on any single authority. This innovation links long-term scarcity directly to code and consensus rather than physical mining or government printing.

What Are Monetary Properties?

To understand how long-term scarcity matters, we first need to examine what makes something function well as money. Classical economics often highlights three core monetary properties:

It should act as a store of value, allowing people to save purchasing power over time.>It should function as a medium of exchange, enabling people to trade goods and services.

It should serve as a unit of account, providing a common way to measure prices and debts.

When we connect these ideas to long-term scarcity and monetary properties, we see that scarcity is particularly crucial for the store of value function. If supply can expand with little cost or limit, then even durable, portable forms of money can lose value through inflation. This is why people often look for assets that combine strong usability with limited supply, whether through nature, law, or code.

How Long-Term Scarcity Supports Store of Value

The store of value function is where long-term scarcity has the greatest impact. When an asset’s supply is credibly limited, holders gain confidence that their share of the total will not be diluted. This confidence can turn into demand, and demand can reinforce the asset’s status as sound money.

When people fear that the supply of money will grow too quickly, they worry that prices will rise over time. This is inflation eroding their savings. Assets that lack long-term scarcity are vulnerable to this problem. In contrast, assets with strong scarcity characteristics are often viewed as an inflation hedge.

Historically, gold fulfilled this role. In modern times, some investors look to digital assets with fixed supply for similar reasons. They see long-term scarcity as protection against unpredictable monetary policy and economic instability. The more predictable the supply, the stronger the perception that the asset can function as a long-term store of value.

However, scarcity alone does not automatically guarantee success. An asset must also be trusted, widely accepted, and secure. When we talk about long-term scarcity and monetary properties, we are really looking for a balance between limited supply and real-world usability.

Gold, Fiat, and Bitcoin: Three Approaches to Scarcity

To see how different forms of money handle scarcity, it helps to compare three major examples: gold, fiat currency, and Bitcoin. Each represents a distinct way of shaping monetary properties.

Gold: Natural Scarcity and Historical Trust

Gold’s scarcity is rooted in nature. It is rare, costly to mine, and cannot be synthesized cheaply. These features have helped gold maintain purchasing power over centuries. Its long-term scarcity is undeniable, which supports its role as a store of value.

Gold also has useful monetary properties. It is durable and does not corrode, it can be divided into smaller units, and it is recognized across cultures. However, it has weaknesses as a modern medium of exchange. It is heavy, difficult to transport in large quantities, and not easily used for everyday digital payments. As a result, gold’s role today is often limited to being reserve wealth rather than daily money.

Fiat Money: Flexible Supply and Policy Trade-Offs

Fiat currencies like the US dollar, euro, or yen are not inherently scarce. Governments and central banks can create more of them through policy decisions. This flexibility allows authorities to respond to crises, smooth economic cycles, and support financial systems.

However, this also means fiat money often lacks long-term scarcity. Over decades, the purchasing power of fiat currencies usually declines due to inflation. While they function well as a medium of exchange and unit of account, their performance as a long-term store of value is more fragile.

The tension between flexibility and scarcity is central to the modern monetary system. People use fiat money daily because it is convenient and widely accepted, yet they may seek alternative assets such as gold or real estate when they want a long-term hedge against inflation.

Bitcoin and Digital Scarcity

Bitcoin introduced the idea of digital scarcity enforced by code. Its supply is capped at a fixed maximum, and new issuance follows a predictable schedule. This design directly targets long-term scarcity and monetary properties, aiming to create a form of money that cannot be inflated at will.

Supporters argue that Bitcoin’s predictable supply makes it a form of sound money for the digital age. It is not backed by a state, but by a decentralized network of participants. Its scarcity is enforced through cryptographic consensus, and its ledger is transparent and hard to alter.

Bitcoin also has strong portability and divisibility. It can be sent across the world within minutes, and it can be split into very small units. These attributes strengthen its monetary properties, especially for people who prioritize sovereignty and resistance to censorship.

However, Bitcoin also faces challenges. Its price can be volatile, adoption is still developing, and regulation continues to evolve. Whether it will fully mature into a widely used unit of account or remain primarily an alternative store of value is still an open question.

Why Scarcity Alone Is Not Enough

It is tempting to think that scarcity automatically guarantees monetary success. But long-term scarcity and monetary properties must be considered together. An asset can be extremely scarce yet fail as money if it lacks liquidity, trust, or usability.

Consider a rare collectible item. It may be very scarce, but if only a few people value it, it will not serve as effective money. It cannot become a broad medium of exchange or a reliable unit of account because too few people accept it.

This is why people evaluate not only the supply schedule of an asset, but also its network effects, its regulatory environment, and the trust it inspires. When these elements align with long-term scarcity, an asset can grow into a powerful form of money.

Long-Term Scarcity in a Digital and Global Economy

Globalization and technology have reshaped how we think about long-term scarcity and monetary properties. Capital moves faster, information spreads instantly, and people can access global markets from a smartphone. In this environment, the demand for reliable stores of value is stronger than ever.

Digital assets have introduced forms of programmable money with built-in rules for supply and transactions. These rules are enforced by code rather than central authorities. They can define issuance schedules, caps on supply, or conditions under which tokens are created or destroyed. This brings a new level of transparency and predictability to scarcity.

At the same time, governments continue to experiment with central bank digital currencies and updated payment systems. While these instruments are digital, they are still based on fiat money and therefore do not necessarily solve the problem of long-term scarcity. They may improve efficiency and access, but they do not automatically create sound money.

In a world of rapid change, people are increasingly aware of the trade-offs between flexible monetary policy and hard monetary assets. This awareness pushes the conversation about monetary properties into everyday discussions about savings, investments, and financial security.

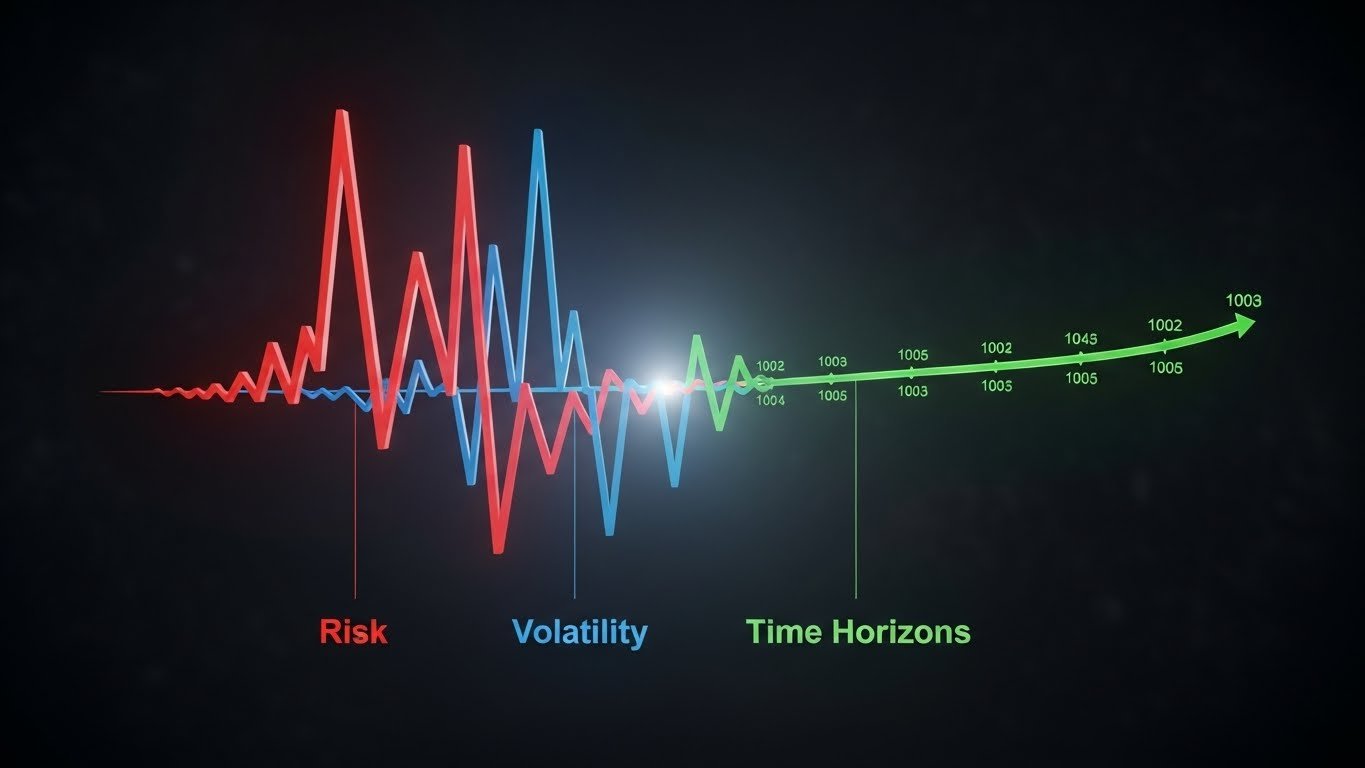

Risk, Volatility, and Time Horizons

When evaluating assets through the lens of long-term scarcity and monetary properties, time horizon plays a crucial role. An asset may be volatile in the short term yet still serve as a strong store of value over decades if its scarcity and adoption trends are robust.

For example, gold has experienced periods of sharp price movements but has generally preserved purchasing power over very long periods. Similarly, newer digital assets may show high volatility early in their adoption cycles, even if their long-term scarcity is well defined.

These factors contribute to whether the asset can truly embody sound money principles and function as a reliable store of value in the long run.

How Long-Term Scarcity Shapes Behavior and Incentives

Scarcity does not only affect prices; it also changes behavior. When people believe an asset exhibits strong long-term scarcity and monetary properties, they are more likely to hold it rather than spend it quickly. This can lead to a savings culture around that asset, where people treat it as their core reserve of wealth.

Fiat currencies, in contrast, often encourage spending and investment rather than saving in cash. Because of ongoing inflation, holding large cash balances over long periods can feel unattractive. This shapes decisions about borrowing, investing, and taking risk.

In systems built around scarce money, people may be more cautious about debt and more focused on long-term planning. In systems built around expandable money, there may be greater emphasis on credit, leverage, and short-term growth.

Neither model is perfect. The choice of monetary system reflects trade-offs between stability, flexibility, and intergenerational fairness. That is why the conversation about scarcity is not just technical, but deeply social and political as well.

The Future of Money: Blending Scarcity and Utility

Looking ahead, the most effective forms of money may combine the strengths of different systems. It is possible that society will continue using fiat money for daily transactions while relying on scarce assets such as gold or digital currencies as long-term stores of value.

In this hybrid model, people might:

Earn and spend fiat because it is convenient and widely accepted

Save and invest in scarce monetary assets to protect against inflation and uncertainty

Use technology to bridge between these worlds through digital wallets, exchanges, and financial services

This blend of functions highlights how long-term scarcity and monetary properties interact in practice. Money is not a single object but a layered system, where different assets play different roles in different time frames.

As technology evolves, new forms of digital scarcity, new regulatory frameworks, and new social norms will continue to reshape the monetary landscape. The core question, however, will remain the same: which assets best protect and transmit value across time?

Conclusion

The relationship between long-term scarcity and monetary properties lies at the heart of how societies save, invest, and trade. Scarcity alone does not guarantee monetary success, but without credible long-term scarcity, it is difficult for any asset to function as a strong store of value.

Gold demonstrates the power of natural scarcity and historical trust. Fiat currencies showcase the flexibility and risks of policy-driven systems that lack strict supply limits. Bitcoin and other digitally scarce assets experiment with programmable scarcity, attempting to merge the benefits of technology with the principles of sound money.

In a global, digital economy, individuals and institutions are rethinking how they balance short-term convenience with long-term security. By understanding how scarcity, trust, and utility come together in different forms of money, you can make more informed decisions about where to hold value, how to manage risk, and how to plan for the future.

Ultimately, the debate over long-term scarcity and monetary properties is much more than an abstract economic discussion. It is about how we protect our work, our savings, and our hopes across years and generations.

FAQs

What does long-term scarcity mean in the context of money?

Long-term scarcity in the monetary context refers to an asset whose supply is limited in a credible, predictable way over many years or decades.

Why is scarcity important for a store of value?

Scarcity is important because it prevents excessive expansion of supply that would erode purchasing power. This confidence can turn the asset into sound money and a reliable long-term savings vehicle.

Can fiat currencies ever have strong long-term monetary properties?

Fiat currencies can have strong monetary properties as a medium of exchange and unit of account, but they usually struggle as long-term stores of value. As a result, fiat money typically lacks long-term scarcity, leading to gradual loss of purchasing power and pushing savers to seek alternative assets with stronger scarcity.

How does digital scarcity differ from physical scarcity like gold?

While gold depends on geological limits, digital scarcity relies on transparent rules embedded in software. Both aim to provide long-term scarcity and monetary properties, but they achieve it through very different mechanisms.

Is an asset with long-term scarcity always a good investment?

Not necessarily. While long-term scarcity is a powerful feature, it does not guarantee success. An asset must also have demand, trust, security, and sufficient liquidity. If very few people value or use an asset, its scarcity may not translate into sustainable price or strong monetary properties. Investors should consider adoption trends, technology, regulation, and macroeconomic conditions along with scarcity when making decisions.