Key Forces Shaping Bitcoin Performance Today

Discover the real factors driving Bitcoin performance, from macro trends to on-chain data, adoption, regulation, and investor psychology.

Before exploring the specific drivers, it is important to understand what makes Bitcoin different from traditional assets. Unlike stocks, bonds, or fiat currencies, Bitcoin is a decentralized digital currency with a fixed maximum supply and no central issuer. This unique design underpins many of the factors that influence Bitcoin performance. Key Forces Shaping.

Table of Contents

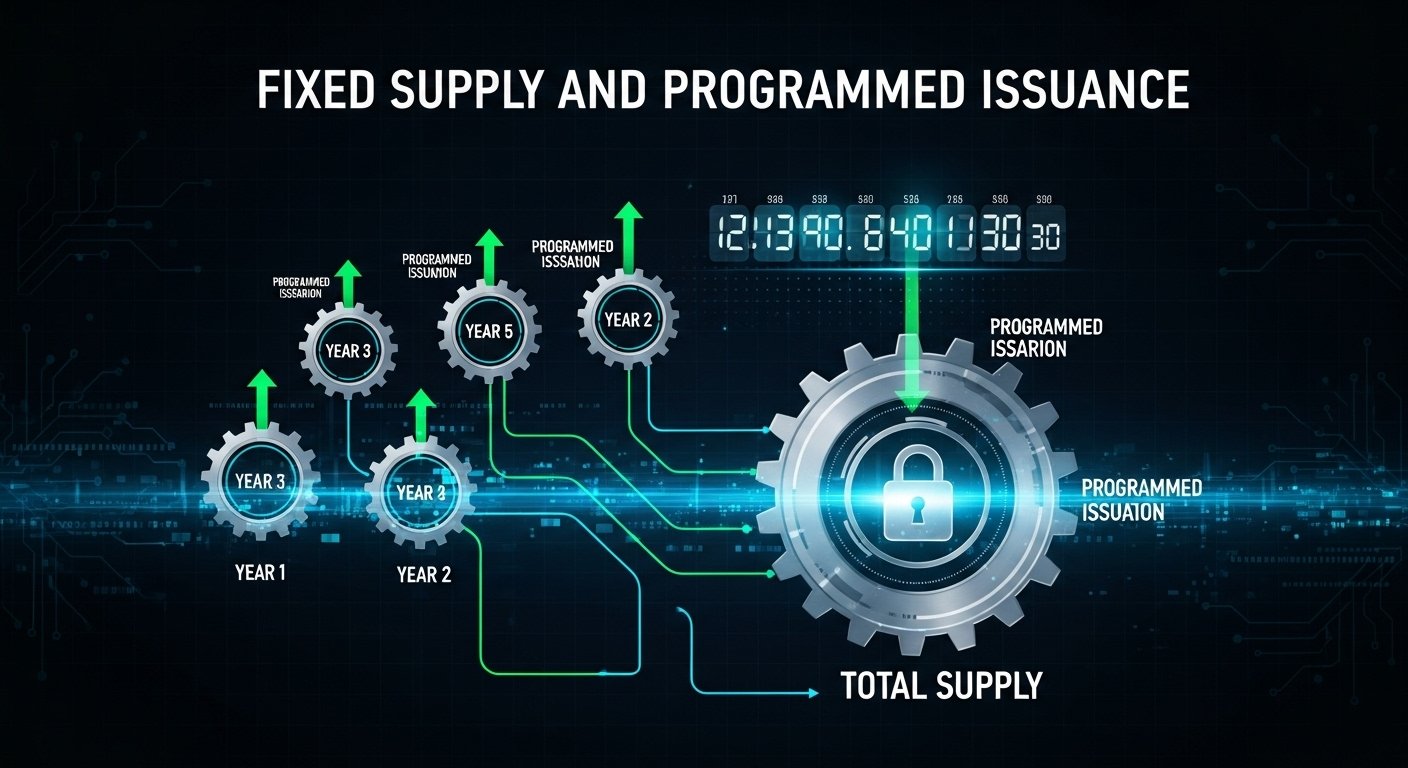

ToggleFixed Supply and Programmed Issuance

Bitcoin’s protocol caps total supply at 21 million coins. New bitcoins are issued as rewards to miners who validate transactions, but this issuance rate decreases over time through halving events. Approximately every four years, the block reward is cut in half, slowing the flow of new supply entering the market.

This makes Bitcoin more similar to a scarce digital commodity than a traditional currency. As more investors understand this scarcity, Bitcoin price performance tends to respond strongly to expectations around future supply and demand. The knowledge that no central bank can print more Bitcoin is a powerful narrative, especially during times of monetary expansion and rising inflation.

Decentralization and Trustless Design

Another key factor is Bitcoin’s decentralized blockchain network, maintained by thousands of nodes around the world. No single entity controls the ledger, and transactions are validated through consensus. This trustless structure gives Bitcoin resilience against censorship and manipulation at the protocol level.

As confidence in traditional financial institutions fluctuates, this decentralization becomes a core reason why some investors treat Bitcoin as a store of value or a hedge against systemic risk. When trust in banks or governments is shaken, interest in Bitcoin often rises, supporting stronger Bitcoin performance over the medium to long term. Key Forces Shaping.

Supply, Demand, and Market Liquidity

At its heart, Bitcoin is still governed by the same economic principles as any other asset: supply and demand. But the way these forces operate in a thin, volatile, and globally traded digital market makes its movement unique.

Halving Cycles and Long-Term Supply Dynamics

One of the most widely watched features of Bitcoin’s design is the halving cycle. Each halving reduces the number of new bitcoins miners receive for validating blocks. As the reward falls, the number of new coins coming to market decreases, assuming miner selling behavior stays similar. Key Forces Shaping.

Historically, halvings have coincided with strong multi-year Bitcoin performance cycles. Investors anticipate the reduced supply and buy in advance, potentially driving prices higher. After the event, if demand remains steady or increases while supply growth slows, upward pressure on price can persist. Although past performance never guarantees future results, halving cycles remain a key narrative in Bitcoin valuation.

Demand from Retail and Institutional Investors

Demand comes from both retail traders and large investors. Retail demand is often driven by social media, news coverage, and the fear of missing out when prices rise quickly. Institutional demand, on the other hand, tends to grow as Bitcoin becomes easier to access through exchange-traded products, custody solutions, and regulated exchanges.

When institutions allocate even a small fraction of their portfolios to Bitcoin, the impact can be significant due to the asset’s limited supply and relatively small market compared with traditional asset classes. As more professional investors treat Bitcoin as a macro asset, both liquidity and market depth improve, which can influence volatility and support sustained Bitcoin performance.

Liquidity and Exchange Infrastructure

Liquidity is another critical piece of the puzzle. Deep order books and high trading volume help absorb large buy and sell orders without causing extreme price swings. As major exchanges and crypto trading platforms have matured, liquidity has gradually improved.

However, during periods of extreme fear or euphoria, liquidity can still thin out, amplifying volatility. Large liquidations on leveraged trading platforms can trigger cascading moves, turning modest corrections into sharp crashes. Understanding how liquidity conditions evolve helps explain why Bitcoin price action can be so intense during key market events. Key Forces Shaping.

Macroeconomic Environment and Global Sentiment

Bitcoin does not exist in a vacuum. Broader economic conditions and global risk sentiment heavily influence Bitcoin performance, especially as more institutional players enter the space.

Interest Rates, Inflation, and Monetary Policy

One of the biggest macro drivers is central bank policy. When interest rates are low and money is cheap, investors often look for higher-risk assets with strong upside potential. Bitcoin, with its high volatility and growth narrative, tends to benefit from these risk-on environments. Key Forces Shaping.

Conversely, when central banks raise rates aggressively to combat inflation, risk appetite can decline. Some investors rotate out of volatile assets and into safer instruments like government bonds or cash. In such periods, Bitcoin may experience selling pressure as part of a broader de-risking trend in global markets.

Inflation also plays a complex role. On one hand, Bitcoin’s fixed supply makes it appealing as a digital hedge against inflation, particularly when there are concerns about fiat currency debasement. On the other hand, high inflation can squeeze consumers and lower their ability to invest in speculative assets, impacting short-term demand. Key Forces Shaping.

Correlation with Traditional Markets

As adoption grows, Bitcoin’s correlation with equity indices and other risk assets has fluctuated. In periods of market stress, Bitcoin often trades in sync with stocks as investors rush to reduce overall risk. During certain bull phases, however, Bitcoin can decouple and outperform traditional markets dramatically.

Traders and analysts watch these correlations closely, as they help frame Bitcoin’s role in a portfolio. Whether it behaves more like a tech stock, a commodity, or a separate asset class can vary from cycle to cycle, and this evolving relationship influences expectations for Bitcoin performance. Key Forces Shaping.

On-Chain Metrics and Network Fundamentals

One of Bitcoin’s unique advantages is the transparency of its underlying blockchain. Anyone can analyze on-chain data, which provides powerful insights into network health and investor behavior.

Hash Rate, Security, and Network Strength

The hash rate measures the total computational power securing the Bitcoin network. A rising hash rate generally indicates more miners participating, which boosts security and confidence in the system. Sustained increases in hash rate often coincide with positive market sentiment, as miners invest heavily in hardware and energy to secure block rewards.

Sharp drops in hash rate, whether due to regulatory crackdowns in certain regions or spikes in energy costs, can create short-term uncertainty. However, Bitcoin’s design allows the network to adjust difficulty over time, helping maintain consistent block production. Strong network security is a key pillar supporting long-term Bitcoin performance and investor trust. Key Forces Shaping.

Active Addresses, Transactions, and Adoption

Metrics such as active addresses, transaction volume, and value settled on-chain offer clues about real usage and adoption. A growing number of unique addresses and sustained transaction activity suggest more people are using and holding Bitcoin, not just trading it.

Higher adoption can support price appreciation by increasing demand and reinforcing the narrative that Bitcoin is becoming a mainstream digital asset. Analysts pay close attention to periods when on-chain activity rises even as price consolidates, as this can signal accumulation and potential future moves in Bitcoin performance.

HODLing Behavior and Market Phases

On-chain tools also allow analysts to distinguish between long-term holders and short-term traders. When long-term holders accumulate and keep coins off exchanges, circulating supply available for sale shrinks. This can create supply squeezes when new demand enters the market. Key Forces Shaping.

Conversely, when long-term holders start sending coins to exchanges, it may indicate profit-taking or growing caution. Understanding these patterns helps identify bull market peaks, bear market bottoms, and accumulation phases, all of which are critical in interpreting Bitcoin price performance over time.

Regulation, Policy, and Legal Clarity

The regulatory environment around digital assets is evolving rapidly, and it has a direct impact on Bitcoin performance and investor confidence.

Regulatory Crackdowns and Market Shocks

Announcements of bans, restrictions, or negative regulatory actions in major markets can trigger sharp sell-offs. Investors may fear limits on trading, withdrawals, or access to exchanges, prompting them to exit positions. These episodes show how sensitive Bitcoin can be to perceived legal risk and uncertainty.

At the same time, Bitcoin’s decentralized structure means the network itself is extremely difficult to shut down. Over the long run, the market often adapts by shifting activity to more friendly jurisdictions and more compliant platforms, restoring some stability to Bitcoin performance. Key Forces Shaping.

Positive Regulation and Institutional Pathways

On the positive side, clear guidelines, licensing regimes, and approval of regulated investment products can significantly boost Bitcoin’s credibility. When regulators outline transparent frameworks for custody, trading, and disclosure, more institutions feel comfortable entering the space.

The emergence of regulated funds, ETFs, and futures products has already made it easier for both retail and institutional investors to gain exposure without directly managing digital wallets or private keys. These developments tend to support stronger, more sustainable Bitcoin performance, as capital flows in through familiar channels.

Media Narratives, Social Sentiment, and Psychology

Bitcoin is as much a psychological and social phenomenon as it is a technological one. Narrative and sentiment play a huge role in driving both short-term volatility and longer-term cycles.

Fear, Greed, and Market Cycles

The crypto market swings between extremes of fear and greed. During bull runs, media coverage often turns overwhelmingly positive, highlighting success stories and dramatic price targets. This attracts new investors who fear missing out, pushing prices even higher.

However, when the cycle turns and prices drop sharply, fear and pessimism dominate. Negative headlines, stories of losses, and speculation about the “end of Bitcoin” can fuel panic selling. Understanding these emotional dynamics is essential for interpreting Bitcoin performance, as sentiment can overshoot reality in both directions.

Influence of Social Media and Key Voices

Platforms like X (Twitter), Reddit, and YouTube have amplified the role of influencers and opinion leaders in the cryptocurrency market. A single tweet or video from a high-profile figure can trigger rallies or sell-offs, especially when markets are already fragile. Key Forces Shaping.

While these individual events may be short-lived, they highlight how social sentiment can accelerate existing trends. Traders who track sentiment indicators, search interest, and social engagement often gain an edge in understanding the short-term drivers of Bitcoin price action.

Technological Progress and Ecosystem Development

Bitcoin’s core protocol is intentionally conservative, but the ecosystem around it continues to evolve. Progress in infrastructure and complementary technologies can indirectly support Bitcoin performance.

Layer-2 Solutions and Scalability

Projects like the Lightning Network aim to make Bitcoin transactions faster and cheaper by executing them off-chain and settling them on the main blockchain. As these layer-2 solutions improve, Bitcoin becomes more practical for everyday payments and micro-transactions.

Better scalability strengthens the narrative of Bitcoin as a functional digital currency, not just a speculative asset. Over time, this can increase real-world usage and demand, supporting more stable growth in Bitcoin performance.

Custody, Security, and Institutional Infrastructure

Advances in custody solutions, hardware wallets, and security practices make it easier and safer to hold Bitcoin for the long term. As more banks and financial institutions offer Bitcoin services, onboarding becomes simpler for new investors.

Improved infrastructure reduces barriers to entry, expands the investor base, and contributes to more mature market behavior. Over years, these developments can transform Bitcoin from a niche speculative instrument into a widely recognized digital store of value, influencing its performance profile. Key Forces Shaping.

How Investors Can Interpret Bitcoin Performance

Long-Term Perspective vs. Short-Term Volatility

Bitcoin is historically one of the most volatile major assets. Short-term price swings can be extreme, driven by liquidations, headlines, or sudden shifts in sentiment. For long-term investors who believe in the underlying technology and scarcity narrative, these swings are often viewed as noise within a larger uptrend.

Maintaining a long-term perspective, focusing on adoption and fundamentals, and avoiding emotional decisions based on daily fluctuations can be crucial for navigating Bitcoin performance over multiple cycles. At the same time, risk management, diversification, and a clear strategy remain essential. Key Forces Shaping.

Conclusion

Bitcoin performance is shaped by a complex interplay of technology, economics, psychology, and policy. Its fixed supply and decentralized design make it fundamentally different from traditional assets, while its integration into global markets links it closely to macroeconomic trends and investor sentiment.

Supply dynamics, especially halving cycles, combine with growing demand from both retail and institutional investors to create powerful bull markets. Macroeconomic conditions, interest rates, and inflation influence risk appetite and the perception of Bitcoin as a store of value. On-chain metrics reveal deep insights into network health and investor behavior, while regulatory developments and infrastructure improvements shape the pace of mainstream adoption.

Media narratives, social sentiment, and psychological factors amplify these forces, driving cycles of fear and greed that can push prices far above or below what fundamentals alone would suggest. For anyone trying to understand or participate in the Bitcoin market, recognizing these drivers and how they interact is essential.

By blending fundamental analysis, macro awareness, and sentiment tracking, you can interpret Bitcoin performance with greater clarity, reduce emotional decision-making, and align your strategy with your risk tolerance and long-term goals. Key Forces Shaping. Key Forces Shaping.

FAQs

Q. Why is Bitcoin so volatile compared to traditional assets?

Bitcoin operates in a relatively young and evolving market with lower overall liquidity than major stock or bond markets. A limited float, leveraged trading, and rapid shifts in sentiment amplify price moves. As a result, even modest changes in demand or large liquidations can lead to sharp swings in Bitcoin performance.

Q. How do halving events affect Bitcoin performance?

Halving events cut the block reward for miners in half, reducing the rate at which new bitcoins enter circulation. If demand stays the same or increases while new supply slows, upward pressure on price can build over time. Historically, strong bull markets have often followed halvings, although the exact timing and magnitude vary from cycle to cycle. Key Forces Shaping.

Q. Does Bitcoin really act as an inflation hedge?

Bitcoin’s fixed supply and decentralized nature support the narrative of a digital inflation hedge. In the long run, some investors view it as protection against currency debasement. However, in the short term, Bitcoin can still behave like a risk asset and may decline during periods of aggressive rate hikes or market stress, even when inflation is high.

Q. How important is regulation for Bitcoin performance?

Regulation plays a major role in shaping access and confidence. Negative news such as bans or strict restrictions can hurt sentiment and trigger sell-offs. On the other hand, clear, balanced regulation and approval of regulated Bitcoin products help attract institutional capital and support more stable, sustainable growth in Bitcoin’s market value. Key Forces Shaping.

Q. What metrics should I watch to understand Bitcoin’s health?

Key metrics include hash rate (network security), active addresses (usage and adoption), on-chain volume (value being transferred), exchange balances (potential selling pressure), and long-term holder behavior (accumulation or distribution). Combining these with macro indicators and sentiment data gives a more complete picture of Bitcoin performance and its likely direction over different time horizons. Key Forces Shaping.