Kalshi Valued at $11B After $1B Round: What It Means

Kalshi valued at $11 billion after a $1 billion funding round. Discover what this massive prediction-market deal means for traders, investors and fintech.

When news broke that was valued at $11 billion after a $1 billion funding round, it instantly turned heads across Wall Street, Silicon Valley, and the broader fintech world. According to a report, the regulated prediction-market platform closed a massive $1 billion financing at an $11 billion valuation, just weeks after raising $300 million at a $5 billion valuation. Kalshi Valued.

In a funding environment where many startups are struggling to raise capital, an $11 billion valuation for a seven-year-old company that lets people trade on real-world events is more than just a headline. It signals that prediction markets are moving from niche curiosity to mainstream financial infrastructure. Investors are betting not only on business model, but on a world where markets that price the probability of elections, inflation, sports, pop culture, and economic data become as normal as stock and options trading. Kalshi Valued.

This article breaks down what the latest funding round reveals about the company’s strategy, its regulatory journey, the broader prediction-market boom, and what this could mean for traders, policymakers, and investors watching from the sidelines. Kalshi Valued.

What Is and How Does It Work?

At its core, is a federally regulated prediction market platform that allows users to trade on the outcome of future events. Instead of buying shares in a company, users buy “yes” or “no” contracts on questions like whether the Federal Reserve will raise interest rates, who will win an election, or what a particular economic indicator will be at a future date. Kalshi Valued.

Each contract settles at either $1 or $0 depending on whether the event occurs, and prices in between represent the market’s implied probability. For example, if a contract on “Will inflation exceed 3% this year?” trades at $0.65, that suggests the market is pricing a 65% chance that the event will occur. This mechanism essentially turns real-world events into tradable assets, blending elements of finance, data, and human psychology.

differentiates itself through regulation. Unlike many crypto-native prediction platforms, it chose the more difficult path of becoming CFTC-regulated, giving it legitimacy in the eyes of institutional investors and regulators. It operates in the gray area between financial derivatives and betting, but with the structure and oversight of traditional markets. Kalshi Valued.

The result is a platform that feels like a hybrid of a derivatives exchange, an information market, and a retail trading app—positioning at the center of a new category of event-driven trading.

From $1 Billion to $11 Billion: Funding Journey

The latest funding round is remarkable not just for its size, but for the speed of the company’s valuation growth. In mid-2025, raised over $100 million in a funding round led by Paradigm, crossing the $1 billion valuation mark and entering unicorn status.

A few months later, in June and October 2025, the platform closed additional rounds: a $185 million raise followed by a $300 million Series D led by Sequoia Capital and Andreessen Horowitz, pushing valuation to around $5 billion and funding its rapid expansion into more than 140 countries.

The newest reported $1 billion funding round at an $11 billion valuation represents a massive jump in just a short period. Sources indicate the round was led by returning heavyweight investors including Sequoia and Capital G, with other backers such as Andreessen Horowitz and Paradigm already on the cap table.

For investors, the $11 billion valuation isn’t just about revenue multiples. It’s about owning a critical piece of infrastructure in an emerging asset class: markets where information and probability are directly tradable. Valued. Kalshi Valued.

Why Investors Are Betting Big on Prediction Markets

The fact that is valued at $11 billion after a $1 billion funding round in the current environment says a lot about investor conviction. Venture capital firms have become more selective about late-stage bets, yet prediction markets seem to be breaking through that caution.

A New Asset Class for a Data-Hungry World

We live in a world saturated with data, but messy when it comes to forecasting. Polls can be wrong, analysts can be biased, and individual experts can miss the mark. Prediction markets like offer a different signal: prices based on people risking real money on specific outcomes.

When thousands of traders collectively take positions, prices become a powerful indicator of crowd-sourced probabilities. For hedge funds, corporates, and even governments, this kind of market-implied data can be invaluable for decision-making—from hedging risks to planning campaigns. Kalshi Valued.

Regulatory Clarity (or at Least Progress)

Historically, prediction markets have been plagued by legal uncertainty. Platforms often walked a fine line between financial instruments and gambling. chose to tackle this head-on by securing CFTC approval and, when necessary, taking regulators to court. It successfully sued the CFTC to list contracts on congressional elections and continues to navigate disputes with certain state regulators.

This willingness to engage with regulators instead of avoiding them has become a core part of competitive moat. It signals to investors that the company is not just chasing short-term growth, but building a long-term, compliant financial market for events. Kalshi Valued.

Explosive Growth in Volume and Reach

remarkable trading volume growth is another reason investors were willing to assign an $11 billion valuation. The platform has reported annualized trading volumes climbing from hundreds of millions to tens of billions of dollars as it broadened its market offerings and went global.

The expansion to over 140 countries and the claim of being the “world’s only unified global prediction market” underline just how ambitious the company’s growth strategy has become.

How $11 Billion Valuation Changes the Industry Landscape

With valued at $11 billion, the prediction-market space is entering a new era. vs. Poly market and Other Rivals

main rival, Poly market, has also raised large funding rounds and attracted institutional interest, including strategic investments from major financial infrastructure players. Reports indicate Poly market has been valued in the high single-digit billions after its own mega-deals.

$11 billion valuation doesn’t just raise the bar for itself; it sets a benchmark for the entire industry. Any competitor now needs a credible story about how they will match or differentiate from a heavily capitalized, regulator-friendly giant.

What the $1 Billion Round Will Likely Fund

A $1 billion war chest gives immense flexibility. While the company has not publicly detailed every use of proceeds, there are several logical areas where this capital is likely to flow.

Legal and Regulatory Battles

Operating a regulated event-trading platform is expensive. has already engaged in significant legal battles with federal and state regulators and may continue to do so as it pushes into new categories like political markets and state-level questions. Kalshi Valued.

The Broader Impact on Traders, Retail Users, and Institutions

The fact that is valued at $11 billion after a $1 billion funding round isn’t just a story about investors. It has real implications for different types of market participants.

Risks and Criticisms: Is an $11 Billion Valuation Justified?

No funding story is complete without examining the risks. Even as valuation jumps to $11 billion, skeptics point to several concerns.

Regulatory Uncertainty Still Looms

Despite progress at the federal level, continues to face opposition from some state-level regulators who view prediction markets as unauthorized gambling. Legal disputes, shifting political attitudes, or future regulatory crackdowns could limit the types of markets is allowed to list or the jurisdictions in which it can operate.

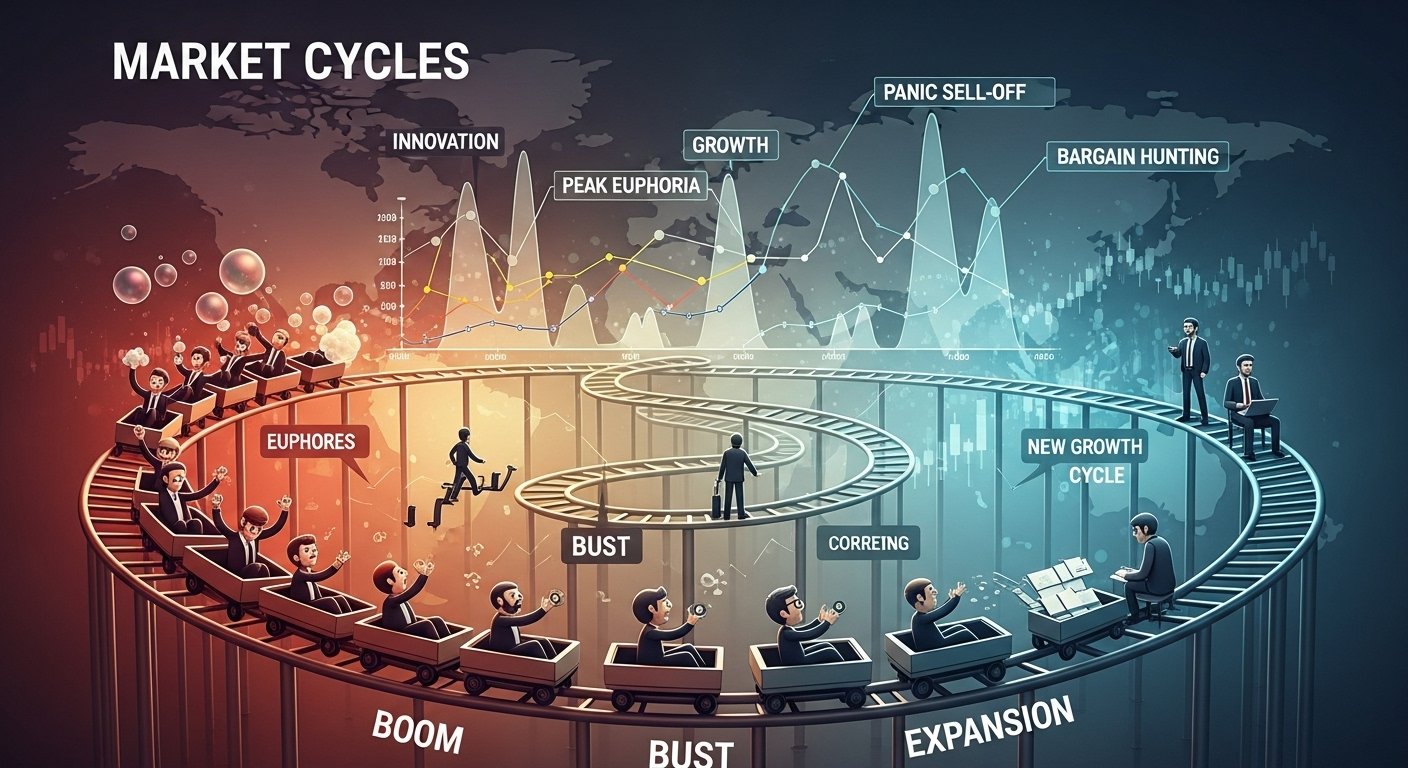

Market Cycles and Speculative Behavior

Prediction markets are inherently tied to speculative activity. While that can drive liquidity and volume, it also exposes platforms to boom-and-bust cycles, especially when retail enthusiasm wanes or regulatory scrutiny tightens.

If event-trading is treated as the “next big speculative fad,” must prove it can maintain sustainable, utility-driven demand, not just attention-driven spikes.

Competitive Pressure

With rivals like Poly market raising large rounds and traditional exchanges exploring event-based products, isn’t alone. The prediction-market sector could become a high-stakes winner-take-most game, where liquidity naturally concentrates on a small number of platforms. i’s ability to defend its lead will depend on continual innovation, regulatory wins, and strong customer trust.

Despite these risks, investors backing at an $11 billion valuation are signaling that the upside of becoming the default global prediction market outweighs the uncertainties. Kalshi Valued.

What This Means for the Future of Prediction Markets

The $1 billion funding round feels like an inflection point. Just as early stock exchanges professionalized equity trading and early crypto exchanges built infrastructure for digital assets, is shaping what a mature event-trading ecosystem looks like.

Conclusion

By combining a regulated framework, aggressive global expansion, and powerful backers like Sequoia, Andreessen Horowitz, and Paradigm, has positioned itself as a frontrunner in turning real-world events into a full-fledged financial asset class.

There are still significant challenges ahead—from regulatory battles to competitive pressures—but the scale of this latest funding round suggests that some of the world’s most sophisticated investors believe prediction markets are here to stay.

For traders, institutions, and observers, the key question now isn’t just whether the valuation is justified. It’s how quickly event-based markets will reshape the way the world prices—and trades on—uncertainty itself.

FAQs About $11 Billion Valuation and $1 Billion Round

Q. What exactly happened in latest funding round?

reportedly raised a $1 billion funding round at an $11 billion valuation, led by returning investors including Sequoia and Capital G. The round follows a $300 million Series D at a $5 billion valuation just weeks earlier, marking one of the fastest valuation climbs in the prediction-market space.

Q. Why is $11 billion valuation significant for prediction markets?

It signals that major investors see long-term value in event contracts, market-implied probability data, and regulated platforms where users can trade on real-world outcomes at scale.

Q. How does differ from other platforms like Poly market?

operates as a CFTC-regulated prediction market with a strong focus on U.S. legal compliance and institutional credibility. Platforms like Poly market, while also large and well-funded, come from a more decentralized, crypto-native background and have faced U.S. access limitations in the past. regulated status is a key part of its appeal to mainstream investors. Kalshi Valued.

Q. What will likely use the $1 billion for?

The capital gives room to invest heavily in product, compliance, and marketing to solidify its market leadership.

Q. Is trading on the same as gambling?

positions itself as a financial exchange for events, not a gambling site. Its contracts function like regulated derivatives, where users hedge or speculate on measurable outcomes such as economic data, policy decisions, or elections. That said, the line between speculation and gambling is a core issue in ongoing regulatory debates, and how authorities classify certain event types will continue to shape business.