BTCUSD News Today, Nov 20: Bitcoin Price Dips After Kraken’s IPO News

BTCUSD news today, Nov 20: Bitcoin price dips after Kraken’s IPO filing as risk-off mood, ETF outflows and macro jitters weigh on BTC/USD despite long-term optimism.

BTCUSD News. The BTCUSD pair is back under pressure today, 20 November 2025, as the Bitcoin price struggles to find its footing in the wake of Kraken’s long-anticipated IPO move. After weeks of speculation, U.S.-based crypto exchange Kraken has finally confirmed that it has confidentially filed for an initial public offering (IPO) in the United States, targeting a listing in early 2026.

On paper, that sounds like the kind of headline that should lift the broader crypto market. Kraken’s IPO comes on the heels of a huge $800 million funding round at a roughly $20 billion valuation, underlining strong institutional interest in digital asset infrastructure even as prices cool off. BTCUSD News.

Yet BTCUSD news today tells a different story. As of this morning, Bitcoin trades near the $92,000 mark, according to major market trackers, after having dipped below $90,000 in recent sessions—its lowest level since April and nearly 30% off the record highs above $126,000 set in early October.

In other words, the Kraken IPO news has landed in the middle of a classic risk-off wave, where macro uncertainty, heavy ETF outflows and profit-taking by whales are hitting Bitcoin harder than bullish headlines can help. BTCUSD News.

Table of Contents

ToggleBTCUSD Today: How Far Has Bitcoin Fallen?

The BTCUSD pair has been in a corrective phase since early October’s all-time highs. After briefly trading above $126,000, Bitcoin has slid into a steep pullback, with the latest leg lower taking it below $90,000 before a modest recovery back toward the low-$90K area.

On 20 November 2025, popular data aggregators show Bitcoin price today hovering around $92,000, with 24-hour trading volumes in the tens of billions of dollars and volatility remaining elevated.So while BTCUSD news today is framed around Kraken’s IPO milestone, the price action is part of a broader, multi-week crypto correction.

BTCUSD intraday tone on Nov 20

This tug-of-war reflects a market caught between extreme fear and structural bullishness. Sentiment gauges and some prediction models still project higher prices in the months ahead, but in the short term, traders are cautious and positioning for ongoing volatility. BTCUSD News.

For short-term Bitcoin traders who watch the BTCUSD live chart closely, this means a market still in defensive mode despite the fundamentally bullish backdrop of a major exchange heading for Wall Street.

Kraken’s IPO Filing: The Big Story Behind Today’s BTCUSD Headlines

What exactly did Kraken announce?

Kraken, one of the world’s largest crypto exchanges, confirmed that it has confidentially filed for a U.S. IPO through its parent company Payward, with a tentative target to list in the first quarter of 2026.

The announcement followed news that Kraken had just completed an $800 million funding round led by heavyweight institutional players, lifting its valuation to around $20 billion—a significant jump from earlier in the year.

Why does Kraken’s IPO matter for Bitcoin?

For BTCUSD traders, Kraken’s IPO plans matter on several levels:New investment gateway

Publicly listed exchange stocks often become a proxy for crypto exposure in equity portfolios. When investors can buy Kraken shares, they are indirectly betting on Bitcoin trading volumes, institutional adoption and the broader blockchain economy. Correlation with BTCUSD

Past data has shown a strong correlation between some listed exchange stocks and the Bitcoin price, suggesting that a successful Kraken listing could tighten the relationship between crypto valuations and equity markets even further. Despite all these structurally bullish signals, BTCUSD news today is dominated by the immediate price dip rather than the long-term upside story. BTCUSD News.

Why Did BTCUSD Dip After Kraken’s IPO News?

At first glance, it might seem odd that Bitcoin price is sliding just as one of its key infrastructure players announces a landmark IPO. However, zooming out reveals several overlapping forces.

1. Sell-the-news behavior

The Kraken IPO had been whispered about all year. Reports of large pre-IPO funding rounds, secondary market activity and target valuations had already been priced into the crypto narrative. When confirmation finally arrived, traders who had bet on the “IPO hype” trade were ready to take profits, especially with BTCUSD already wobbling near key support levels. That kind of sell-the-news reaction is common in both crypto and equity markets: once an anticipated bullish catalyst becomes official, speculators often exit.

Against this backdrop, Kraken’s IPO news is more of a bright spot in a cloudy sky rather than a trend-changing event. The BTCUSD pair is trading more as a macro risk proxy than as a direct reflection of exchange-specific headlines.

3. Technical breakdowns amplify the move

Technical analysis shows that when Bitcoin broke below key psychological levels and moving averages, trend-following funds and leveraged traders escalated the selling. BTC sliding below $90,000 triggered additional downside orders and liquidations, which pushed price deeper even as some whales started nibbling at the dip. In this environment, even bullish BTCUSD news like Kraken’s IPO filing can get drowned out by the momentum of the downtrend.

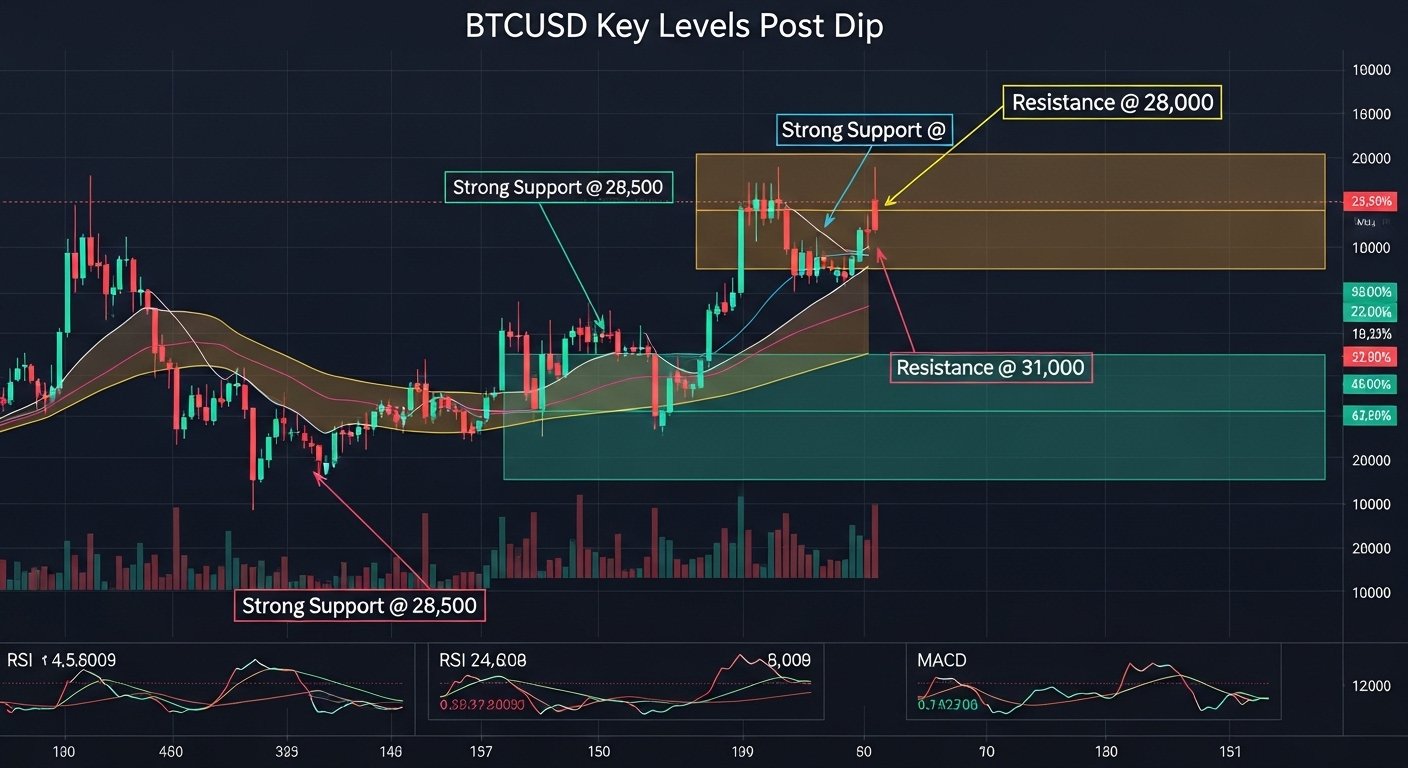

Technical View: Key BTCUSD Levels After the Dip

For traders watching the BTCUSD live chart, a few price zones stand out as especially important in the wake of the recent correction. BTCUSD News.

Immediate support: High-$80K to low-$90K band

Recent coverage highlights that Bitcoin’s drop below $90,000 marks a return to levels not seen since April. This puts the high-$80K to low-$90K zone in focus as a “historical demand area,” where previous dips attracted meaningful dip-buying interest from both retail and institutional players. Analysts tracking historical order books and on-chain data describe this region as a place where long-term holders are willing to accumulate, particularly when sentiment flips to extreme fear. BTCUSD News.

Overhead resistance: Mid-$90K and $100K+

On the upside, the first challenge for BTCUSD is reclaiming the mid-$90K region where recent intraday rallies have stalled. Above that, the psychological $100,000 mark remains a major resistance level and sentiment pivot: For now, the Bitcoin technical analysis picture is one of consolidation after a sharp drop, not yet a clear V-shaped recovery.

On-Chain and Derivatives: What Smart Money Is Doing

While price is the most visible component of BTCUSD news today, serious traders also watch on-chain metrics and derivatives data for clues.

For BTCUSD traders, that combination—whale accumulation plus cautious but not panicked derivatives positioning—often signals a late-stage corrective environment rather than the start of a new macro bear market.

What Kraken’s IPO Could Mean for BTCUSD in the Long Run

Even though the immediate price reaction has been a dip, Kraken’s IPO path is arguably bullish for Bitcoin over a longer time horizon. BTCUSD News.

Deeper integration with traditional markets

A successful listing would further blur the lines between crypto exchanges and mainstream financial institutions. As Kraken joins other public players like Coin base and recently listed peers such as Gemini and Bullish, crypto becomes more firmly anchored in the public markets ecosystem.

Regulatory clarity and investor confidence

Kraken’s ability to move ahead with an IPO under the current U.S. regulatory framework hints at a more stable, if still evolving, environment for crypto firms. Laws like the Genius Act, which targets stablecoin regulation, and proposed measures like the Clarity bill are shaping a clearer rulebook.

Greater clarity can, over time, reduce some of the headline-driven volatility that has plagued BTCUSD, making it easier for long-term capital to enter the space.

Network effects for Bitcoin

As Kraken and other exchanges expand into equities, derivatives and tokenized assets, they are building multi-asset platforms where Bitcoin remains the anchor asset.

The more that global investors interact with these platforms—whether through trading, staking, or accessing spot Bitcoin ETFs—the stronger Bitcoin’s network effects become. That, in turn, supports the long-term BTCUSD uptrend, even if short-term corrections like today’s dip are sharp and uncomfortable. BTCUSD News.

How Traders and Investors Can Approach BTCUSD After the Dip

Nothing in BTCUSD news today changes a core truth about Bitcoin: it is both an emerging macro asset and a highly speculative instrument. That dual nature makes risk management essential.

From a narrative standpoint, nothing about Kraken going public is bearish for Bitcoin adoption. The short-term dip in BTCUSD is more about macro conditions and positioning than about the health of the ecosystem itself.

Conclusion

In other words, Kraken’s IPO news and the current BTCUSD dip are not contradictions—they’re two sides of the same evolving story. Crypto is maturing, integrating with Wall Street and gaining regulatory structure, even as its flagship asset, Bitcoin, continues to trade with the volatility of a young, high-beta macro instrument.

For long-term observers, the takeaway is clear: short-term price swings around IPO headlines are noise; the structural trend toward deeper institutionalization of Bitcoin and crypto is still very much in play. BTCUSD News.

FAQs on BTCUSD News Today and Kraken’s IPO

Q. Why is BTCUSD down today even though Kraken filed for an IPO?

BTCUSD is down today primarily due to a broader risk-off environment, record outflows from major Bitcoin ETFs, and a multi-week correction from October’s all-time highs. Kraken’s IPO filing is fundamentally bullish for the ecosystem, but in the short term, traders are taking profits and de-risking, which outweighs the positive impact of the IPO headline.

Q. Did Kraken’s IPO news cause the Bitcoin price drop?

There is no clear evidence that the IPO news caused the drop. The decline in BTCUSD began earlier and is linked to macro forces like reduced rate-cut expectations, political uncertainty, and heavy profit-taking after a big rally. Kraken’s announcement likely triggered some “sell-the-news” behavior at the margin, but the main drivers of the move are broader market conditions and technical breakdowns.

Q. What does Kraken’s IPO mean for Bitcoin in the long term?

Long term, Kraken’s IPO is a positive signal for Bitcoin and the BTCUSD pair. It confirms that large, regulated exchanges can access public markets; it brings more traditional investors into contact with crypto; and it deepens the integration between digital assets and traditional finance. Over time, this can support greater liquidity, more sophisticated products like spot Bitcoin ETFs, and a broader investor base for Bitcoin. BTCUSD News.

Q. What key BTCUSD levels should traders watch after the dip?

Traders typically watch the high-$80K to low-$90K zone as a crucial support area that has historically attracted dip-buyers. On the upside, the mid-$90K region and the $100,000 handle are important resistance levels; a sustained break above $100K would be seen as an early sign that the correction is losing strength. These zones are not guarantees, but they provide reference points when analyzing the BTCUSD chart.

Q. Is this a good time to buy BTCUSD after the drop?

Whether it is a “good time” to buy BTCUSD depends on individual risk tolerance, time horizon, and overall portfolio strategy. Analysts note that Bitcoin may be entering a value zone, with whales accumulating and sentiment in “extreme fear,” which historically has sometimes preceded strong rebounds. However, volatility remains high, macro conditions are uncertain, and further downside is still possible. Anyone considering BTCUSD should be prepared for large price swings and should never risk more than they can afford to lose.