Bitcoin Sell-Off May Be Complete, Year-End Rally Possible, Says Standard Chartered

Bitcoin’s latest slide triggered record withdrawals from BlackRock’s IBIT ETF. Learn what the outflows mean for BTC price, ETFs and investors.

Bitcoin Sell-Off May Be Complete. The recent Bitcoin slide has done more than rattle speculative traders. It has triggered record withdrawals from BlackRock’s iShares Bitcoin Trust (IBIT), the world’s largest spot Bitcoin ETF and a bellwether for institutional demand for the asset. According to fund flow data, investors pulled roughly $523 million from IBIT in a single day, the largest outflow since the fund launched in January 2024.

This sharp exodus came as Bitcoin’s price dropped below $90,000, its lowest level in about seven months and a stark reversal from its all-time highs in October. The combination of a price correction, fading risk appetite and changing macro expectations has turned what was once a one-way inflow story into a sobering reminder: even the most successful spot Bitcoin ETF is vulnerable when sentiment turns.

In this in-depth look, we’ll unpack why the Bitcoin slide spurred record withdrawals from BlackRock’s IBIT, what it reveals about institutional behavior, how it fits into the broader crypto ETF landscape, and what long-term holders should realistically expect from here.

How BlackRock’s IBIT Became the Flagship Bitcoin ETF Bitcoin Sell-Off May Be Complete

Bitcoin Sell-Off May Be Complete. When BlackRock launched iShares Bitcoin Trust (IBIT) in January 2024, it immediately became the centerpiece of the new wave of U.S. spot Bitcoin ETFs. Thanks to BlackRock’s global distribution network, brand credibility and aggressive marketing, IBIT attracted tens of billions of dollars in assets within months, quickly overtaking rivals like Fidelity’s FBTC.

As Bitcoin’s price retreated, the spot Bitcoin ETFs—which track the underlying asset—naturally followed. IBIT, with heavy exposure and a large shareholder base, felt the impact most visibly.

This means heavy outflows are not just a paper event. They can directly translate into real selling pressure on the Bitcoin spot market, especially when multiple ETFs are seeing redemptions simultaneously.

In this case, IBIT’s record withdrawals occurred during a broader wave of outflows across U.S. spot Bitcoin ETFs, reinforcing the downward push on price and helping turn a correction into a more sustained crypto market drawdown.

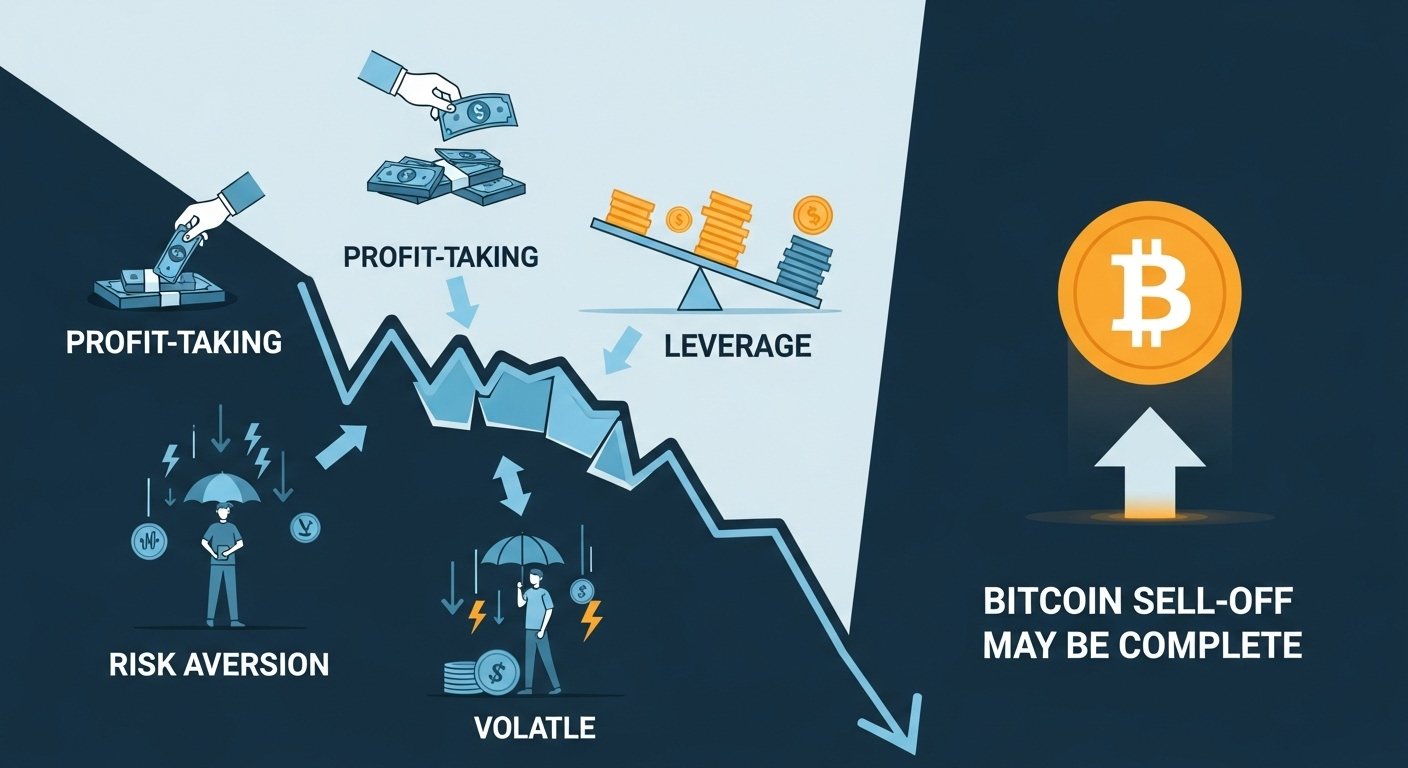

Why Investors Are Pulling Cash: Profit-Taking, Leverage and Risk Aversion Bitcoin Sell-Off May Be Complete

So what prompted such a sharp turn from inflows to outflows at BlackRock’s flagship Bitcoin ETF?

Analysts quoted in recent coverage noted that long-term shareholders have been trimming positions as valuations stretched and short-term sentiment weakened.

Leverage Unwinding and the “Hangover” Phase

Another key piece is leverage. During bull runs, both retail and institutional traders tend to borrow money to increase exposure, amplifying gains but also future losses. As Bitcoin’s price declined, many of these leveraged positions became unsustainable.

Kraken’s global economist described the current environment as a “hangover”, arguing that demand driven by borrowed money peaked months ago and is now reversing as investors de-risk. This unwinding of leverage can create cascading selling in futures, spot markets and ETFs.

Shifting Back Toward Gold and Traditional Havens

Perhaps the most telling development is that some investors appear to be rotating from Bitcoin back into gold, or at least questioning Bitcoin’s status as “digital gold.” While Bitcoin and IBIT have dropped amid the latest bout of risk-off sentiment, gold has remained comparatively resilient, reinforcing its role as a traditional safe-haven asset.

Bitcoin Sell-Off May Be Complete. As valuations across assets become more stretched, certain large investors are reportedly re-allocating from high-beta plays like crypto toward more defensive positions, including gold and cash.

What the IBIT Withdrawals Reveal About Institutional Sentiment Bitcoin Sell-Off May Be Complete

One reason the headline “Bitcoin slide spurs record withdrawals from BlackRock’s IBIT” resonates so strongly is that IBIT is widely viewed as a proxy for institutional confidence in Bitcoin.

Bitcoin Treasury Firms and Discounted Valuations

Another revealing data point is the behavior of Bitcoin treasury firms—public companies that hold large Bitcoin reserves on their balance sheets. Over the past year, these firms collectively bought around $50 billion in Bitcoin, yet many are now trading at discounts to their net asset value, implying that equity investors are skeptical about the sustainability of this strategy.

Bitcoin Sell-Off May Be Complete. This discount weighs on expectations for new corporate Bitcoin purchases and, by extension, reduces some of the structural demand that helped fuel the previous rally. When ETF investors, corporate treasuries and leveraged traders all turn more cautious at once, the result is a powerful drag on price.

IBIT vs Gold: Is “Digital Gold” Losing Some Shine?

The comparison between Bitcoin and gold has been a defining narrative for years: Bitcoin as a scarce digital asset that could rival or even surpass gold as a store of value. The performance of IBIT versus gold ETFs in recent months provides a nuanced update on that story.

Correlation With Risk Assets, Not Just Gold

Analysts note that IBIT’s returns have often tracked risk-on assets like technology stocks and broad equity indices such as the S&P 500 and Nasdaq-linked ETFs, rather than moving consistently with gold. That means: What This Means for Portfolio Construction

For portfolio managers, the message is clear: while a spot Bitcoin ETF like IBIT can be a powerful diversifier and potential return enhancer, it behaves more like a high-volatility growth asset than a traditional hedge.

That doesn’t invalidate the “digital gold” narrative, but it underscores that Bitcoin’s market behavior is still evolving and heavily influenced by macro liquidity, speculation and sentiment.

Are Record Withdrawals a Red Flag or a Reset?

For many investors, the natural question is whether the record withdrawals from BlackRock’s IBIT mark the beginning of a prolonged downturn, or simply the kind of shakeout that often follows parabolic moves.

What This Means for Individual Investors in Bitcoin and IBIT

If you are a retail or high-net-worth investor holding IBIT or considering a position, the recent turbulence carries several practical lessons.

Bitcoin Sell-Off May Be Complete. But they do not shield you from market risk. When Bitcoin slides, ETF holders experience similar drawdowns.

Time Horizon and Risk Tolerance Matter More Than Ever

Given Bitcoin’s history of boom-and-bust cycles, the decision to hold IBIT should be grounded in:

If you see Bitcoin and BlackRock’s IBIT as long-term exposure to a new monetary technology, short-term record outflows may be concerning but not decisive. If you are trading on a short horizon, however, these flows are crucial signals about current sentiment and momentum

Macro Policy and Liquidity Conditions

Bitcoin’s performance is tightly linked to expectations about interest rates, inflation and global liquidity. If central banks remain cautious about easing, risk assets like crypto could remain under pressure. ETF Flow Trends Across the Sector

Bitcoin Sell-Off May Be Complete. While IBIT is the headline-grabber, its behavior must be viewed alongside other spot Bitcoin ETFs. If outflows remain broad-based across multiple funds for weeks, it may suggest a deeper, prolonged risk-off cycle. If flows quickly stabilize or turn positive again, the recent withdrawals could be seen as capitulation rather than the start of a structural reversal.

Sentiment Around Bitcoin Treasury and Corporate Adoption

Finally, keep an eye on public companies holding Bitcoin reserves and any fresh announcements of corporate adoption. Persistent discounts to net asset value and a lack of new entrants would weaken the “institutional adoption” narrative; renewed enthusiasm could support a rebound in both Bitcoin and IBIT.

Conclusion

The headline “Bitcoin Slide Spurs Record Withdrawals From BlackRock’s IBIT” captures more than just a rough trading day.

Bitcoin Sell-Off May Be Complete. Even the most successful Bitcoin ETF is not immune to the realities of risk management and profit-taking.

On the other side, IBIT’s size, longevity and central role in the market underscore that Bitcoin is no longer a fringe asset. The fact that its ebb and flow are now measured in hundreds of millions of dollars in daily ETF creations and redemptions speaks to just how embedded it has become in the global investment ecosystem.

FAQs

Q. Why did the Bitcoin slide cause record withdrawals from BlackRock’s IBIT?

The record withdrawals from BlackRock’s IBIT were largely driven by a combination of Bitcoin’s sharp price drop below $90,000, profit-taking from investors who had enjoyed strong gains earlier in the year, and an unwinding of leveraged positions.

Q. Do large outflows from IBIT mean institutions are abandoning Bitcoin?

Not necessarily. Many institutional investors are likely recalibrating position sizes in response to macro uncertainty and volatility, rather than exiting Bitcoin altogether. Historically, similar episodes of heavy redemptions have been followed by renewed inflows when conditions stabilize.

Q. How do IBIT withdrawals affect the actual Bitcoin price?

Because IBIT holds physical Bitcoin, large redemptions can translate into real selling pressure on the underlying asset. When investors sell IBIT shares in bulk, authorized participants redeem those shares and may sell the corresponding Bitcoin into the spot market. When several spot Bitcoin ETFs see outflows simultaneously, these flows can amplify downward price moves, especially in already fragile market conditions.

Q. Is Bitcoin still a good hedge if it falls while gold rises?

The recent period, in which gold has held up or gained while Bitcoin and IBIT have fallen, highlights that Bitcoin currently behaves more like a high-volatility risk asset than a pure safe haven.

Q. Should long-term investors worry about record withdrawals from BlackRock’s IBIT?

For long-term investors with a strong conviction in Bitcoin’s future, record withdrawals from IBIT are a signal to pay attention to, but not necessarily a reason to panic. They highlight that sentiment is weak and volatility is high, which may lead to further price swings. The key is ensuring that your position size matches your risk tolerance and time horizon.

See more; Bitcoin ETF Approval News 2025 Complete Guide to Regulatory Updates & Market Impact